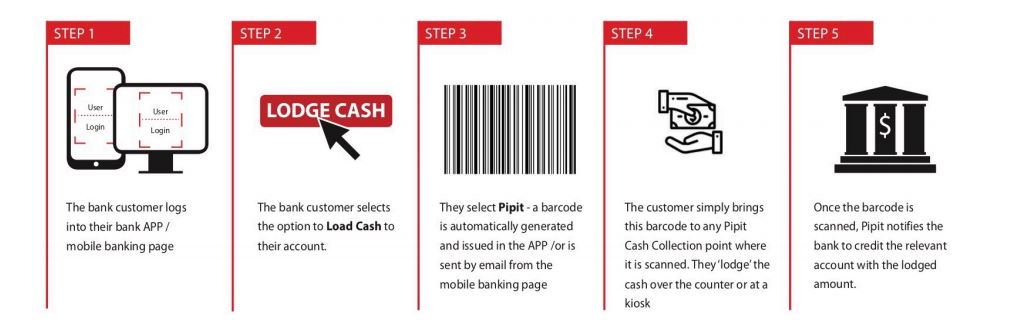

Why is Pipit banking good for your bank?

Cash-friendly initiatives successfully boost Financial Inclusion in developing economies by supporting the fact that cash is integral to the daily life of it’s citizens.

Pipit banking offers a unique opportunity to democratize banking in developing economies by bringing large numbers of its unbanked population into their system, and helping customers to leverage their bank accounts in a cost-effective, meaningful, reliable and secure way.

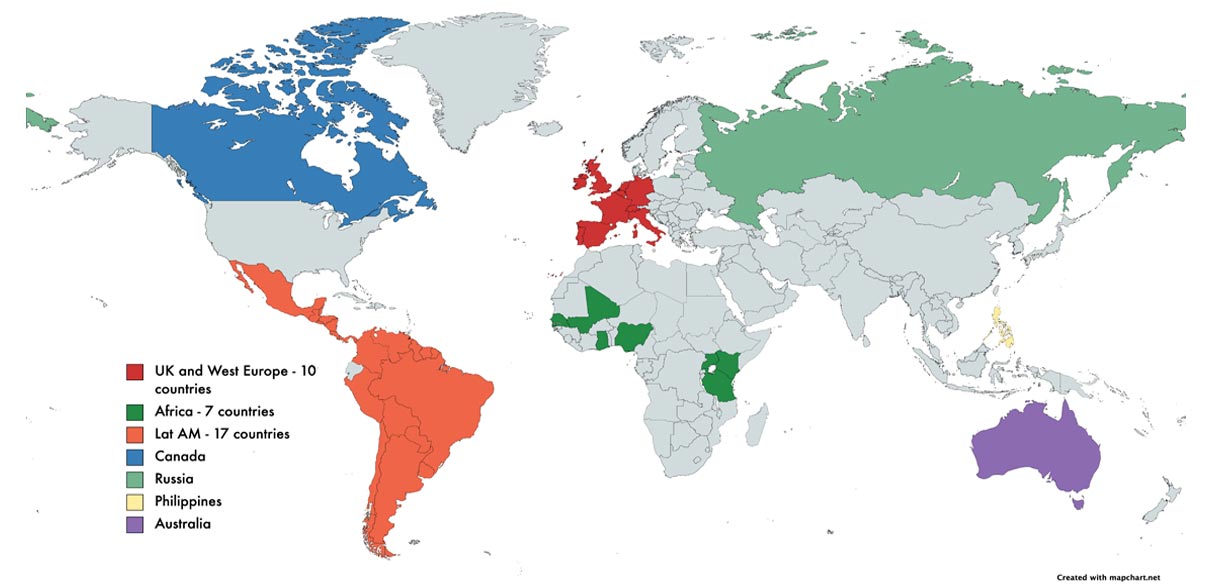

Pipit banking gives your customers what they want – low transaction costs, worldwide access and convenience through a service that is relevant to their needs.